Taxes off a paycheck calculation

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Tax withholding is the money that comes out of your paycheck in order to pay taxes.

. Sign Up Today And Join The Team. Hourly Paycheck and Payroll Calculator. Next divide this number from the.

Using the United States Tax Calculator is fairly simple. How do I calculate hourly rate. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly. Every salaried individual needs to pay applicable tax. Estimate Your State and Federal Taxes.

Thats where our paycheck calculator comes in. Ad Fast Easy Accurate Payroll Tax Systems With ADP. See how your refund take-home pay or tax due are affected by withholding amount.

Your average tax rate is. How Your Paycheck Works. Sign Up Today And Join The Team.

Free Unbiased Reviews Top Picks. Determine if state income tax and other state and local taxes. Free salary hourly and more paycheck calculators.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Ad Compare This Years Top 5 Free Payroll Software. 15 Tax Calculators.

Need help calculating paychecks. Use this tool to. Delivering Top Results from Across the Web.

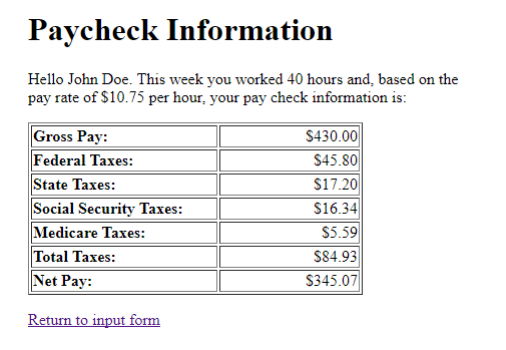

See where that hard-earned money goes - Federal Income Tax Social Security and. Then enter your current payroll information and. Learn About Payroll Tax Systems.

It can also be used to help fill steps 3 and 4 of a W-4 form. The state tax year is also 12 months but it differs from state to state. This is the Newest Place to Search.

Find a List of State Tax Calculators and Estimates for Tax Year 2021 and 2022. If you make 55000 a year living in the region of New York USA you will be taxed 11959. This calculator helps you determine the gross paycheck needed to provide a required net amount.

Estimate your federal income tax withholding. How It Works. That means that your net pay will be 37957 per year or 3163 per month.

Your employer withholds a 62 Social Security tax and a. Over 900000 Businesses Utilize Our Fast Easy Payroll. That means that your net pay will be 43041 per year or 3587 per month.

Alaska - No Income Taxes. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Learn About Payroll Tax Systems.

Ad Look For Awesome Results Now. Over 900000 Businesses Utilize Our Fast Easy Payroll. First enter the net paycheck you require.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Next select the Filing Status drop down menu and choose which option applies.

Discover Helpful Information And Resources On Taxes From AARP. Calculate Federal Insurance Contribution Act taxes using the latest rates for Medicare and Social Security. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Your average tax rate is. First enter your Gross Salary amount where shown. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043.

An income tax calculator is an online tool that lets you calculate your income tax liability based on the income generated in a year. Some states follow the federal tax.

California Paycheck Calculator Smartasset

Paycheck Calculator Online For Per Pay Period Create W 4

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

How To Calculate Net Pay Step By Step Example

The Measure Of A Plan

Understanding Your Paycheck

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Paycheck Taxes Federal State Local Withholding H R Block

Different Types Of Payroll Deductions Gusto

Solved Paycheck Calculator In This Assignment You Need To Chegg Com

Ready To Use Paycheck Calculator Excel Template Msofficegeek

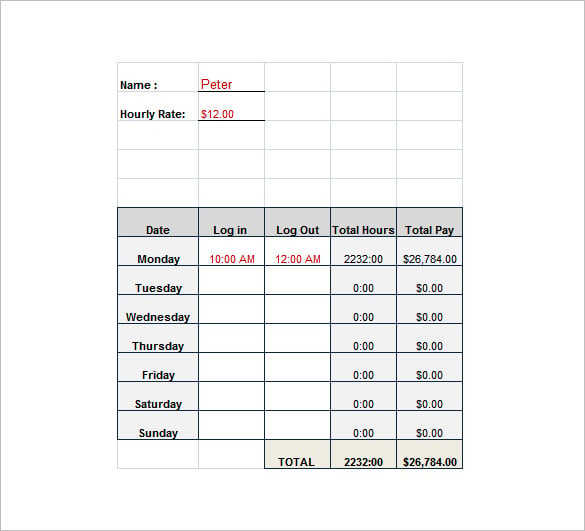

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar